Little Known Facts About Manhattan Life Assurance.

Wiki Article

About Plan G Medicare

Table of ContentsNot known Facts About Medicare Plan G JokeEverything about Medicare Plan G JokeFascination About Attained Age Vs Issue AgeBoomerbenefits.com Reviews Fundamentals ExplainedWhat Does Medicare Plan G Joke Do?Some Known Incorrect Statements About Medicare Plan G Joke

50 of the $185 accepted price, supplier will with any luck not be prevented from serving Mary or various other QMBs/Medicaid recipients. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance since the Medicaid rate ($120) is lower than the quantity the company already obtained from Medicare ($148) - manhattan life assurance. For both Medicare Benefit and Original Medicare, if the costs was for a, Medicaid would certainly pay the complete 20% coinsurance despite the Medicaid price.If the service provider desires Medicaid to pay the coinsurance, then the company must sign up as a Medicaid service provider under the state policies. This is a change in plan in implementing Section 1902(n)( 3 )(B) of the Social Safety And Security Act (the Act), as customized by area 4714 of the Well Balanced Spending Plan Act of 1997, which restricts Medicare companies from balance-billing QMBs for Medicare cost-sharing.

QMBs have no lawful responsibility to make further repayment to a service provider or Medicare managed treatment plan for Component A or Part B cost sharing. Providers that inappropriately costs QMBs for Medicare cost-sharing are subject to permissions.

CMS reminded Medicare Advantage strategies of the regulation against Equilibrium Billing in the 2017 Telephone call Letter for strategy renewals. See this excerpt of the 2017 telephone call letter by Justice in Aging - It can be tough to show a provider that is a QMB. It is especially hard for providers who are not Medicaid suppliers to identify QMB's, considering that they do not have access to online Medicaid eligibility systems If a customer reports an equilibrium billng issue to this number, the Customer Service Rep can escalate the complaint to the Medicare Administrative Contractor (MAC), which will certainly send out a compliance letter to the supplier with a duplicate to the customer.

Hearing Insurance For Seniors Fundamentals Explained

These adjustments were set up to go right into effect in October 2017, however have been postponed. Learn more about them in this Justice in Aging Issue Brief on New Techniques in Fighting Improper Billing for QMBs (Feb. 2017). (by mail), even if they do not also receive Medicaid. The card is the mechanism for healthcare service providers to bill the QMB program for the Medicare deductibles and also co-pays.A consumer that has an issue with debt collection, might additionally send a complaint online or call the CFPB at 1-855-411-2372. TTY/TDD individuals can call 1-855-729-2372. need to complain to their Medicare Advantage plan. In its 2017 Telephone call Letter, CMS worried to Medicare Benefit contractors that federal guidelines at 42 C.F.R.

Hyperlinks to their webinars and other sources is at this web link. Their info consists of: September 4, 2009, upgraded 6/20/20 by Valerie Bogart, NYLAG This write-up was authored by the Empire Justice.

Hence, participants have to undergo a redetermination to continue receiving benefits for the list below year. This procedure consists of providing your local Medicaid workplace with updated information regarding your monthly revenue and also total sources. If somebody doesn't have Component A yet is eligible, they can choose to sign up anytime throughout the year.

The Facts About Manhattan Life Assurance Revealed

The initial action in registration for the QMB program is to locate out if you're eligible. You can ask for Medicaid to supply you with an application form or situate a QMB program application from your state online.

There are instances in which states may restrict the amount they pay wellness care providers for Medicare cost-sharing. Even if a state limits the quantity they'll pay a supplier, QMB members still do not have to pay Medicare carriers for their healthcare costs and it's against the law for a provider to inquire to pay.

A Medicare Benefit Unique Needs Strategy for dual-eligible individuals might be a great option. Typically, there is a costs for the strategy, but the Medicaid program will certainly pay that premium. Many individuals pick this added protection due to the fact that it offers routine oral and vision care, as well as some included a health club subscription.

Unknown Facts About Boomerbenefits Com Reviews

Select which Medicare plans you would certainly like to contrast in your area. Compare prices side by side with strategies & providers offered in your area.He is featured in numerous magazines in addition to composes regularly for various other expert columns relating to Medicare.

Numerous states allow this throughout the year, yet others limit when you can sign up in Part A. Remember, states make use of different try here rules to count your revenue and also possessions to determine if you are eligible for an MSP. Instances of revenue include wages as well as Social Safety and security advantages you get. Instances of properties consist of inspecting accounts and also stocks.

Boomerbenefits Com Reviews for Dummies

Extra Aid covers points like: regular monthly premiumsdeductiblescopays for prescriptions, Some drug stores might still charge a small copay for prescriptions that are covered under Component D. For 2021, this copay is no more than $3. 70 for a generic medication as well as $9. 20 for each brand-name medicine that is covered. Extra Assist just relates to Medicare Component D.If you're enrolled in the QMB program, the following suggestions will help make sure that your medical care prices are covered: Allow a medical care specialist recognize that you're enlisted in the QMB program. Program both your Medicare as well as Medicaid cards or QMB program card whenever you seek treatment. If you receive a bill that must be covered by the QMB program, get in touch with the healthcare professional.

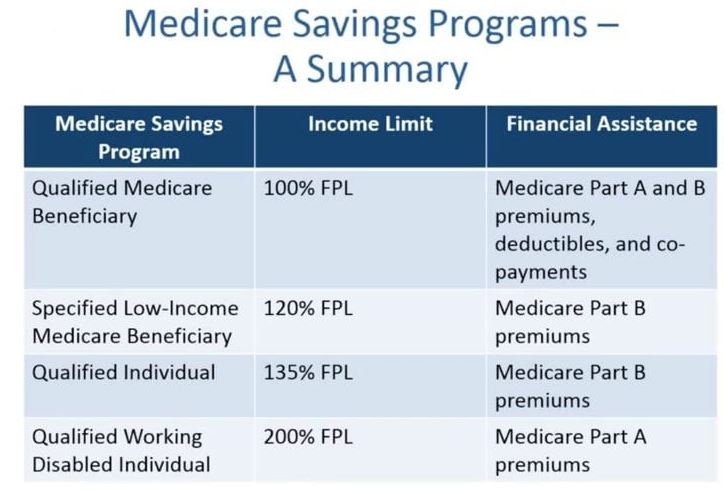

MSPs, including the QMB program, are carried out via your state's Medicaid program. That indicates that your state will certainly figure out whether or not you qualify. Different states might have various methods to determine your earnings as well as sources. Let's analyze each of the QMB program eligibility standards in even more detail listed below.

The Single Strategy To Use For Medigap Plan G

, the resource limitations for the QMB program are: $7,970 $11,960 Resource limits likewise increase every year. As with revenue restrictions, you must still use for the QMB program if your sources have slightly boosted.Report this wiki page